The banking industry today is more competitive and fast-paced than ever. Relationship Managers (RMs) face constant pressure to meet client expectations while managing complex financial products and adhering to strict regulations. Many struggle to handle tough client objections, manage multiple accounts, and still deliver personalized service, often resulting in missed opportunities and lower client satisfaction. In this scenario, AI coaching for Relationship Managers is emerging as a practical solution to improve sales conversations, build confidence, and help RMs engage clients more effectively.

Key Challenges for Banking Relationship Managers

- Handling tough client objections – Many RMs struggle to respond confidently to questions about loans, fees, or investment products, which can affect client trust.

- Explaining complex financial products – RMs often find it difficult to simplify and communicate complicated products clearly to clients.

- Improving sales and persuasion skills – Some RMs miss opportunities for cross-selling or upselling due to lack of structured pitch and persuasion techniques.

- Building confidence for client meetings – High-pressure discussions or presentations can make RMs nervous, affecting their effectiveness.

- Time and task management during client interactions – Balancing multiple clients and accounts efficiently is challenging and can impact service quality.

Why Banks Need to Adopt AI Coaching for Relationship Managers

- Enhancing Communication Skills – AI coaching helps RMs speak clearly, structure their messages, and connect better with clients.

- Boosting Confidence in Decision-Making – By practicing realistic scenarios, RMs feel more confident making quick and informed decisions.

- Encouraging Adaptive Thinking – AI trains RMs to adjust their approach depending on different client behaviors and situations.

- Tracking Progress Over Time – AI tools monitor performance and show improvements, helping RMs understand their growth areas.

- Reducing Dependency on Supervisors – Self-guided AI coaching allows RMs to learn independently without constant manager support.

How Awarathon Prepares Banking Relationship Managers to Handle Client Objections

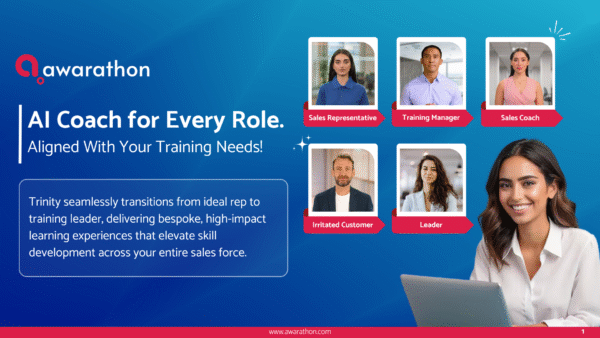

Awarathon

Awarathon is trusted by leading banks and financial organizations for its AI based training platform. It provides multilingual support and one-on-one skill coaching to help Relationship Managers build confidence and improve their communication skills. The platform also includes custom AI personas that simulate different customer behaviors such as calm, angry, or distracted clients, allowing RMs to practice real world interactions in a safe environment. Each module works together to help banking teams handle objections more effectively and turn challenging client conversations into opportunities for success.

-

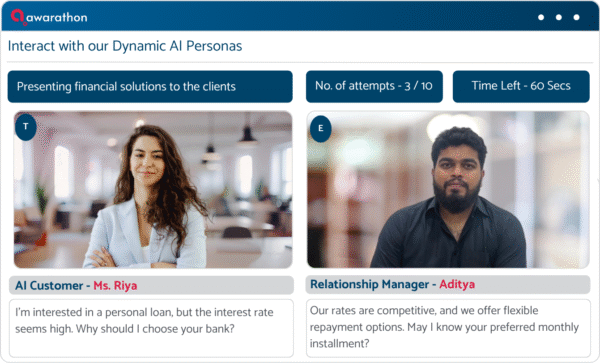

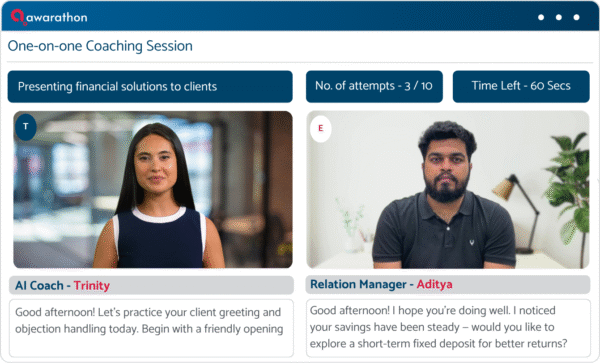

Practice Real Client Objection Scenarios

Trinity creates realistic client simulations for different banking situations. It can simulate an angry client upset about a loan delay, a rushed customer who wants quick investment advice, or a confused client who doesn’t understand interest rates. Relationship Managers practice these conversations with the AI Coach and get instant feedback on clarity, tone, and accuracy. This helps them stay confident and handle real client meetings more effectively.

-

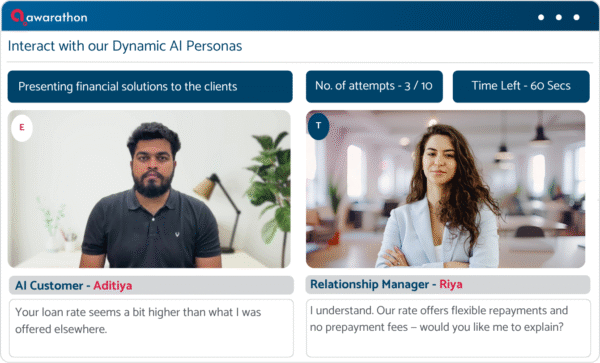

See How an Ideal Relationship Manager Responds to Clients

In reversed roleplays, Trinity acts as the relationship executive while the learner takes the role of the customer. This allows relationship managers to see their communication from the customer’s perspective. Trinity delivers responses exactly as an RM would in a real conversation, including tone, phrasing, and approach. By observing this, learners can identify where explanations may be unclear, see how objections are handled, and understand how persuasive their answers are. This practice helps RMs refine their style, improve clarity, and develop better strategies to handle objections in real customer meetings.

-

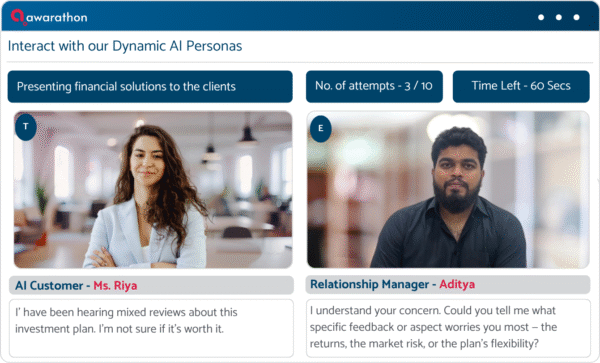

Master Probing Conversations with Trinity

Trinity trains RMs to ask the right questions to uncover the real client concerns behind objections. For instance, if a client hesitates about an investment product, the AI suggests follow-up questions to explore their priorities, risk tolerance, or doubts. By practicing these probing techniques, RMs learn to address objections effectively and offer personalized solutions.

-

Personalized AI Coaching for Relationship Managers

Trinity provides one-on-one guidance tailored to each relationship manager’s performance. The AI Coach observes interactions and gives feedback specific to the RM’s strengths and areas for improvement. It helps RMs understand how their communication is perceived by the customer, identify unclear or unconvincing messages, and adjust their approach. This personalized coaching enables RMs to handle objections more effectively, build confidence, and improve overall customer interactions.

-

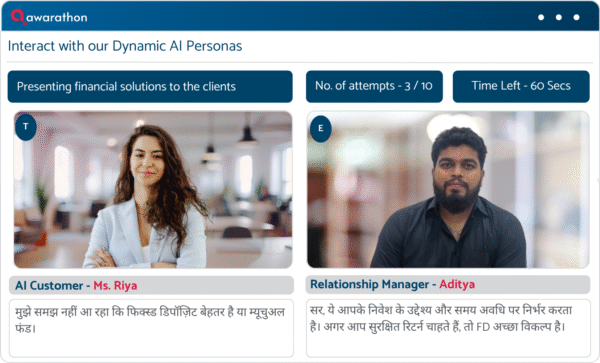

Train Relationship Managers in Regional Languages with AI Coaching

Relationship Managers interact with clients from different regions, many of whom prefer to speak in their local language. In daily banking interactions like explaining a loan, discussing investments, or resolving service issues speaking the customer’s language helps build trust and comfort. Most training programs focus only on English, which doesn’t reflect real-world conversations. Awarathon’s AI Coach bridges this gap by training Relationship Managers in 22+ languages, including 10+ Indian regional languages. It allows RMs to practice real client interactions in the same language they use at work, helping them communicate clearly, build stronger connections, and handle every client conversation with confidence.

-

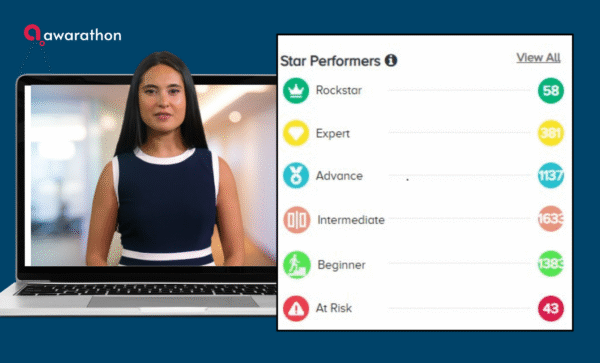

Real-Time RM Performance Tracking

Awarathon makes performance tracking simple and motivating. Managers can view real-time leaderboards to see which Relationship Managers are excelling and who needs extra support. Each milestone from completing simulations to acing quizzes adds to an RM’s achievement record. Certifications and rankings not only recognize top performers but also inspire others to improve. By turning learning into a healthy competition, Awarathon builds confidence, drives motivation, and keeps every Relationship Manager striving for excellence.

How Trinity Trains Relationship Managers on Different Customer Behaviour

Relationship Managers often deal with a variety of customer behaviors during daily interactions. Some customers are calm and patient, while others might be curious, confused, frustrated, or in a hurry. Awarathon’s AI Coach, Trinity, recreates these diverse customer types through custom AI personas, allowing RMs to experience and respond to real world situations before they happen.

Through these simulations, Relationship Managers learn how to adapt their tone, communication, and problem-solving approach to suit each client’s mood and mindset. Trinity’s instant feedback helps them improve clarity, empathy, and confidence, enabling them to manage objections smoothly and build stronger, long-lasting customer relationships.

Types of Customer Relationship Managers Encounter

- Cautious Customers- Trinity trains the relationship managers to stay calm and answer objections with confidence. The managers learn to respond to tough questions about loans, investments, or insurance products. They also learn how to manage customer doubts in a professional way. This helps the relationship managers maintain credibility and build trust even in difficult conversations.

- Curious Customers- Trinity acts as a curious customer to help the relationship managers practice explaining banking products clearly. The managers learn to understand the customer’s needs, give simple and personalized advice, and answer all questions effectively. This improves communication and builds strong, long-term customer relationships.

- Distracted Customers- Trinity acts as a distracted customer to help the relationship managers practice keeping the customer’s attention. The managers learn to focus the conversation, explain key benefits clearly, and re-engage customers who are multitasking or not paying full attention. This ensures that the customer understands important information.

After every session, Trinity gives instant feedback on the manager’s pitch, tone, and approach. This helps the relationship managers learn faster and perform better in real customer meetings.

With Trinity, banking teams do not just train. They experience realistic customer interactions, improve confidence, enhance objection-handling skills, and build stronger customer relationships.

The Trusted Choice for Businesses Worldwide

Try Awarathon Free for 15 Days – Book Your Spot Now!

In today’s fast-changing banking environment, the ability to handle client objections with confidence and clarity is essential for every Relationship Manager. AI coaching is transforming how RMs build these skills by offering practical, hands-on learning experiences. With Awarathon’s AI Coach, Trinity, managers can engage in realistic client simulations, practice challenging conversations, and receive instant, personalized feedback on their performance. This continuous coaching helps them improve communication, strengthen persuasion, and develop a deeper understanding of customer behavior. By adopting AI coaching, banks can create more confident, well-prepared, and customer-focused teams who turn every client objection into an opportunity for stronger relationships and better results.

Frequently Asked Questions

-

Which is the top AI sales training platform for banking teams?

Awarathon is one of the top AI sales training platforms trusted by leading banks. Its AI Coach, Trinity, helps Relationship Managers practice real client scenarios, improve objection handling, and gain instant feedback to boost confidence and sales performance.

-

What are the main benefits of AI-based training for Relationship Managers?

AI-based training provides personalized feedback, tracks performance in real time, and allows RMs to learn at their own pace. It enhances objection handling, customer communication, and sales techniques making them more effective in real banking situations.

-

How can AI coaching help Relationship Managers in banking?

AI coaching helps Relationship Managers improve communication, objection handling, and customer engagement through interactive simulations. It allows them to practice real client conversations, receive instant feedback, and build confidence before meeting customers.

-

How can banks implement AI coaching for Relationship Managers?

Banks can implement AI coaching by integrating an AI-powered training platform like Awarathon. It enables Relationship Managers to practice client conversations, get performance-based feedback, and track progress. Training modules can be customized for different banking products, customer types, and regional languages.

-

Can AI coaching improve customer satisfaction in banking?

Yes. By training Relationship Managers to communicate effectively and handle customer emotions with empathy, AI coaching improves client satisfaction and strengthens long-term relationships.