Introduction :

Cold calling is one of the most challenging tasks for an insurance agent, as it requires confidence, quick thinking, and effective communication. Traditional training methods are often time consuming and inconsistent, leaving the agent unprepared for real world conversations. AI training for cold calling is a smarter approach that provides personalized simulations, instant feedback, and actionable insights. This article explains the top five ways AI training for cold calling can help an insurance agent boost confidence, refine the pitch, and improve sales results.

Challenges Insurance Agents Face in Cold Calling

- The Fear of Rejection – It is common for agents to feel nervous when calling strangers and worry about being turned down.

- The Lack of Confidence – Without enough practice, it is difficult for agents to speak confidently and handle questions.

- Handling Objections – It is often challenging for agents to respond effectively to customer doubts or objections.

- Limited Preparation – It is hard to be ready for every type of customer or scenario.

- Difficulty Engaging Customers – Some agents struggle to capture the customer’s attention and keep them interested during the call.

How AI Training Helps Insurance Agents Overcome Cold Calling Challenges

- The AI training helps agents overcome the fear of rejection by letting them practice with simulated customers before making real calls.

- It builds confidence as the AI provides instant feedback on how the agent speaks, responds, and presents.

- The AI coach trains agents to handle different objections smoothly with the right tone and approach.

- It helps agents prepare better by exposing them to various customer types and call situations.

- The AI makes it easier for agents to keep customers engaged by improving how they start, continue, and close conversations.

Here Are the Top 5 Ways Awarathon’s AI Training Transforms Cold Calling for Insurance Agents

Awarathon is a leading AI sales training platform that helps organizations across industries enhance the way their sales, operations, and customer service teams learn, practice, and perform through realistic simulations and personalized AI mentoring.

The simulation in Awarathon replicates real client interactions, allowing insurance agents to practice live scenarios in a realistic, risk-free environment. Through these AI-driven simulations, agents can refine their communication, improve objection handling, and perfect their pitch while receiving instant, data-backed feedback. This hands-on approach helps build confidence, empathy, and consistency, making every training session more engaging and effective.

Below are 5 ways Awarathon’s AI training helps insurance agents improve their cold-calling performance.

-

Realistic Cold Call Simulations

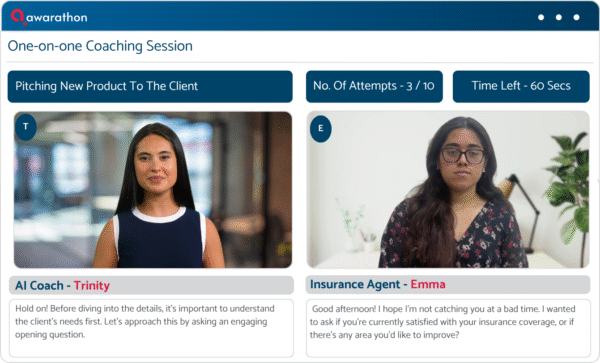

The Trinity AI Coach provides an interactive training experience through one-on-one coaching, reverse roleplay, and two-way simulations. In one-on-one sessions, agents practice real conversations and receive targeted guidance to improve their tone, delivery, and confidence. The reverse roleplay feature helps them understand the customer’s perspective, while two-way simulations recreate real interactions to build empathy, adaptability, and strong communication skills.

-

Multilingual and Regional Adaptability

Most training platforms offer only English, but Awarathon’s AI Coach, Trinity, allows insurance agents to practice cold calling in their preferred language. By training in a language they are comfortable with, agents can improve clarity, confidence, and communication skills, ensuring they handle real client conversations more effectively across diverse regions.

-

Intent Detection and Mapping

The Intent Detection and Mapping feature in Awarathon analyzes the intent behind both insurance agents’ and prospects’ responses during cold calls, such as curiosity, hesitation, or objections. It measures how effectively agents address client concerns and communicate policy details. By tracking intent throughout each conversation, the system gives managers deeper insights into call quality, enabling targeted coaching and data-driven improvement for better client engagement and higher conversion rates.

-

Track Agent Actions and Results Immediately

The AI platform makes it easy to track each agent’s actions and results in real time. Every cold-calling session is recorded and analyzed to evaluate how the agent communicates, handles objections, and responds to customer cues. The insights are shared instantly, allowing managers to measure progress, identify strengths, and focus on specific areas for improvement.

-

Personalized Coaching for Each Agent

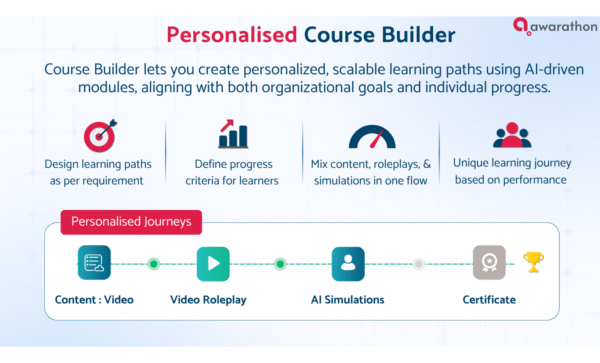

The AI Coach acts as a personal mentor for every insurance agent, guiding them step by step through each cold-calling session. After every call simulation, it provides personalized feedback on tone, clarity, and delivery, helping agents refine their communication and grow more confident. The training experience is fully tailored to each agent’s performance, ensuring faster improvement and lasting skill development.

Case Study: How TATA AIA Transformed Agent Training with Awarathon

TATA AIA, with a team of 3,500 agents, used Awarathon’s AI Coach to transform their training process. The platform allowed agents to train in over 22 regional languages, simulating real client interactions to improve product knowledge, communication, and objection-handling skills. Managers could monitor each agent’s progress and provide personalized support, ensuring consistent and effective training across the entire organization.

Click here to read the full case study

The Measurable Impact of Awarathon

- 25% faster customer interaction time

- 50% improvement in skill competency

- 25% growth in brand visibility

- 50% higher learner engagement

Trusted by Leading Organizations Across the Globe

- Aditya Birla Capital

- SBI Life

- Tata AIA

- Bajaj Finserv

- Novartis

- Abbott Nutrition

- Sun Pharma

- Dr. Reddy’s

Boost Your Team’s Cold Calling Skills – Access Your Free 15-Day Awarathon Trial!

- Request Your Demo – Fill out the form, and our team will connect with you to understand your cold calling training needs.

- Join a Guided Walkthrough – See how Awarathon and the AI Coach, Trinity, help insurance agents practice real client interactions and refine their pitch.

- Set Up Your Accounts – Share the client segments or teams you want to focus on, and we’ll create a personalized training environment.

- Get Instant Access – Start your customized demo immediately and begin practicing cold calls right away.

- Explore for 15 Days – Use all features for free, engage in realistic client simulations, receive AI-driven feedback, and track your team’s progress.

Click here to access your free trial.

Conclusion :

AI training is transforming cold calling for insurance agents, and Awarathon leads the way with its intelligent AI Coach, Trinity. By providing realistic client simulations, instant feedback, and personalized coaching, agents gain confidence, improve communication, and handle objections effectively. Trusted by leading organizations, Awarathon delivers measurable results in skill development, engagement, and sales performance.

Frequently Asked Questions

-

What is AI training for cold calling?

AI training for cold calling is a modern learning approach that uses artificial intelligence to simulate real customer conversations. It helps insurance agents practice their calls, receive instant feedback, and improve their communication skills with the help of data-driven insights and personalized coaching.

-

How does AI training help insurance agents improve their cold calling performance?

AI training helps insurance agents improve their performance by recreating realistic client scenarios. The agent can practice pitching, handle objections, and build confidence in a safe environment. The AI Coach also provides instant feedback on tone, clarity, and delivery, making the learning process faster and more effective.

-

What makes Awarathon’s AI Coach different from traditional cold calling training?

Awarathon’s AI Coach, Trinity, is different because it offers personalized simulations, multilingual support, and instant performance analysis. Unlike traditional methods, it gives continuous, data-backed feedback that is tailored to each agent’s skill level, helping them learn faster and achieve measurable results.

-

Can AI training help insurance agents handle client objections better?

Yes, AI training can help insurance agents handle client objections more effectively. It allows agents to practice with various simulated client types including hesitant, demanding, or uninterested ones so they can build confidence, clarity, and composure in real sales conversations.

-

How can an insurance company get started with Awarathon’s AI training for cold calling?

An insurance company can get started by requesting a free 15-day trial on Awarathon’s website. The Awarathon team will set up a personalized training environment, create customized simulations, and provide access to the AI Coach, Trinity, so agents can immediately start practicing real cold calls and tracking their progress.